How To Manage My Budget – If you’re not sure how to stick to a budget, you’re not alone. Many business owners work hard to create a business budget. they calculate revenue sources, calculate expenses, forecast future one-time expenses and combine them only to struggle with budget management and implementation.

Why is it so? Why is implementation and management so difficult? More importantly, what can you do to better manage and stick to your budget?

How To Manage My Budget

There are a variety of reasons why business owners struggle to manage and stick to a budget. Unlike budgeting, budget implementation and management is an ongoing process that is difficult to maintain. It requires:

Free Expense Tracker Apps You Need In Your Life Right Now

The good news is that you don’t have to struggle. Read on to learn how to improve your budget management with these budgeting tips.

Of course, proper budget management and implementation starts with creating a realistic budget that you are likely to stick to in the first place. Follow these five steps to create a balanced budget:

For an in-depth study on creating a budget, read Create a Small Business Budget in 5 Simple Steps.

If you look at the revenue on an annual basis, it can seem like an unrealistic number to manage. To ground your budget in your day-to-day reality, you need to change the perspective from yearly to weekly or monthly.

Essential Budget Categories For Your Financial Needs

Doing so makes your budget more manageable. You also know your spending better financially and can identify early on if you’re over budget. This, in turn, gives you enough time to identify budget gaps and adjust to them.

If you don’t budget for the odd treat, frustration and resentment can set in, which can even lead to overspending and a blown budget.

So instead of looking at your budget as just a frugal living plan, see it as a plan that helps you understand your spending habits and makes you a conscious spender.

Including some “indulgences” in your planned spending will stop your budget from feeling like the enemy. It will also help you enjoy those “treat” moments without guilt or fear.

How To Manage Your Money: The New 50/20/20/10 Budgeting Method 2021

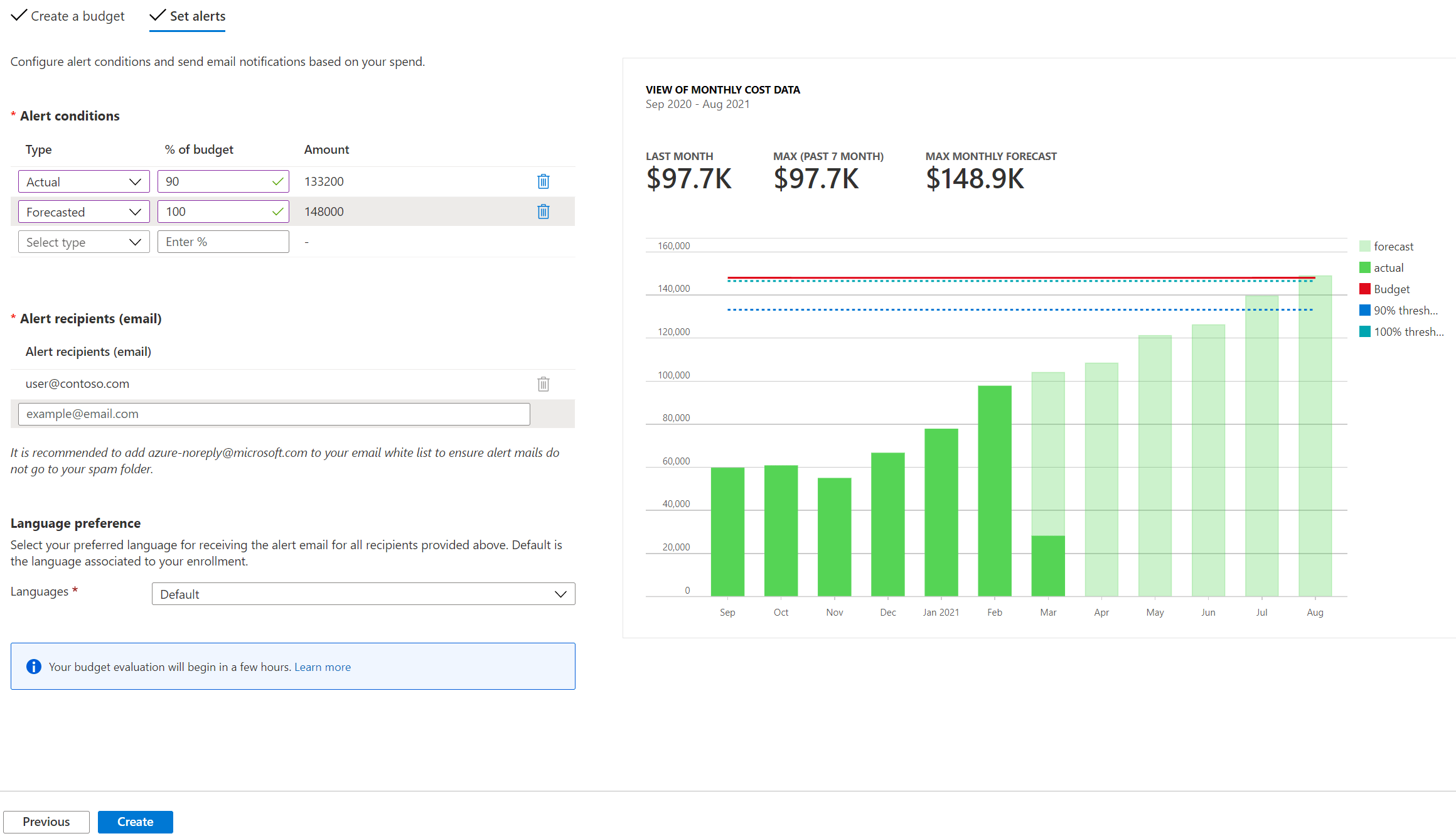

An effective budget is only as good as the information it contains. And for that information to be valuable, you need to keep it up to date by regularly tracking your income and expenses and capturing any changes as they occur.

Imagine this. The end of the month comes with you over budget and unable to pay your bills. By tracking your expenses every day, you avoid these scenarios and can improve your budget management by:

Pro tip: when budgeting, your income remains conservative and understates your monthly income to give you a margin of safety.

By comparing your actual income and expenses to your budget, you can determine whether your budget is over or under, and make quick changes without negatively impacting your business.

All In One Budget Proposal Template

For example, let’s say you budgeted $2,000 a month for business expenses, but soon discovered you underestimated by several hundred dollars. Now you need to adjust your budget accordingly, that is, increase one budget category at the expense of another.

Making such adjustments, or even admitting that your budget was unrealistic to begin with, is part of sound budget management. Ultimately, budgeting will always involve some estimation and trial and error to get it down. Embrace it!

A bank reconciliation or “bank statement” is the process of comparing your cash balances with your bank statements to see if they match. Any discrepancy or difference is usually recorded on the bank reconciliation statement.

A business will perform bank accounting for many reasons, to achieve accuracy in accounting, to protect against fraud, and to prevent errors from being transferred to financial statements, but it is often overlooked as a budget management tool.

Best Budget Templates & Tools That Will Change Your Life

Because a bank record includes keeping a close eye on all transactions, it provides a window into your spending habits and shows you where you can make changes to stay within budget.

Your bank reconciliation also gives you an accurate overview of how much money is in your business account at a given point in time, so you can quickly gauge whether you’re on track to meet your budget.

A big part of budgeting is forecasting and tracking expenses. Unfortunately, many small business owners struggle to track their expenses or even differentiate between personal and business expenses because they don’t have separate personal and business accounts.

When it comes to tracking income and expenses for budget management purposes, you can use spreadsheets like Excel or even cloud accounting software.

Printable Monthly Family Budget Worksheet

Using spreadsheets may seem cost-effective, but it’s time-consuming because you have to manually enter expense and income information. You should also always go through endless bank statements to verify the accuracy of your accounting records.

A better approach is to use accounting software that makes it easy to track expenses and income and helps you quickly identify your spending patterns.

The right software allows you to monitor expenses without lifting a finger, so you always know how you’re spending your money. All you need to do is connect your bank account.

You can also access all your invoices and revenue in one place to see if you’re on track to meet your revenue targets and even client or project revenue.

Best Budgeting Apps Of February 2023

Finally, you can access dashboard summaries to view income and expense reports that give you an at-a-glance overview of how your business is doing. Simply compare these reports to your budgeted amounts to measure how well you’re doing.

Talk to your bank and arrange for the amount received to be automatically transferred to the main pockets of your budget every month. investments, savings and fixed expenses (utilities, mobile phone, subscriptions).

This automation removes the temptation to stop any payments and prevents you from overspending as money leaves your account like clockwork every month.

A big part of sticking to a budget is controlling spending. You can do this by paying yourself first, setting aside money for Uncle Sam, and aggressively budgeting your expenses.

How To Make A Budget: Your Step By Step Guide

Paying yourself first means that a portion of your paycheck is automatically deposited into a savings account each month.

You can use these savings for retirement, building an emergency fund, or other financial goals. The main reason to pay yourself first is to prevent overspending and ensure you have enough saved up before any non-essential purchases and expenses.

During the year, money should be set aside for taxes. If you don’t, you won’t be able to pay Uncle Sam, and you’ll be scrambling to collect the money you need. T

hat doesn’t mean your budget will be unbalanced.

The solution is to budget for tax dates. Important quarterly tax dates in the United States are:

How To Manage Your Entire Marketing Budget [free Budget Planner Templates]

A budget should include expenses that you can afford and justify. But there will be times when you’re tempted to spend beyond what’s in your budget. Maybe you need new technology or software. Or, maybe you have a large project that requires outsourcing.

No matter what the temptation may be, you must understand that you must trade budgeted expenses for unplanned expenses, assuming that the estimated income matches the actual income.

If actual income does not match your budget expectations, you may need to reduce your estimated expenses. A great place to start is to eliminate unnecessary subscriptions that you no longer use.

Plan for rainy days because they will come. Unless you are clairvoyant, you cannot predict and plan absolutely all events. But that doesn’t mean you can’t create a plan to take advantage of off-budget opportunities.

Zero Based Budgeting: What It Is And How To Use It

Service businesses like yours often experience fluctuations in revenue from one month to the next. These fluctuations can be caused by differences in workload, maybe you’ve lost a client, or seasonal changes, maybe you’re a landscaper with a noticeably quieter winter period.

Unplanned expenses are also increasing. Maybe your car is in need suddenly, or you need a new laptop because the hardware has failed.

You should plan ahead and prepare for the above scenarios so that you can cover your expenses. If you don’t, you’ll go over budget and struggle to find extra cash.

One way to prepare is to include a line labeled Emergency Fund in your budget. Then specify to transfer money to that account every month.

Release Highlights Of S/4hana Cloud, Public Edition For Public Sector (us), 2302

When opportunities arise that involve unbudgeted expenses or investments, you want to be able to make them work. By setting clear business goals for the year and prioritizing them, you can do just that.

These goals become the yardstick against which you compare any opportunity, asking yourself: Does the opportunity fit my business goals? If not, scratch it and move on.

For example, if one of your business goals is to get more customers, a budget opportunity to attend a customer-rich networking event may be worth the money. But it will not be a budget opportunity to buy discounted technology, because in this case it does not meet your goal.

If you manage a team of employees, involve them early in the budgeting process. Early involvement encourages employee buy-in, helps maintain budget accuracy, and improves the chances of creating realistic budgets you can actually stick to.

Top Down Budgeting

Approach the right employees in specific departments to get the revenue and expense numbers you need. For example, if you run an agency, speak up

How to manage budget effectively, how to manage family budget, how to manage household budget, how to manage department budget, how to manage budget, how to manage personal budget, how to manage project budget, how to manage grocery budget, how to manage your budget, how to manage home budget, how to manage a budget, how to manage monthly budget