How To Boost Your Credit – Everyone has a credit score and it speaks volumes about your financial health and management. Generally speaking, the better your credit, the better you manage your money.

As we all know though, life happens, and sometimes unexpected circumstances can affect your life (and your credit). Losing a job, getting an emergency car repair, getting divorced or dipping into your savings can stop paying your bills and negatively impact your credit. Fortunately, there are ways to rebuild your credit if you face financial challenges.

How To Boost Your Credit

We’ve narrowed down 10 steps on how to improve your credit score, from knowing what your score means to simple routines and strategies you can put in place to boost your score and work toward financial freedom.

Improve Your Credit Score

Canada has two national credit bureaus: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail and it should arrive within a few weeks. All you have to do is provide some basic identification information and mail in the form. If you want instant results online, you will be charged a small fee.

The first step to improving your credit is really knowing where you stand (which is why checking your credit score is so important).

Once you receive your credit report, you need to interpret what your score means. Your credit score is a three-digit number between 300 (poor) and 900 (excellent). Our blogs can help you understand what the average credit score is by age in Canada, credit score ranges in Canada and where your credit score falls on the scale.

If you need additional support, you can also check out the Government of Canada’s resources for understanding your credit report.

Stop Borrowing Money To Improve Your Credit Score

As you review your credit report, watch for misinformation. If you notice any errors in your file, such as someone else’s information, debts that don’t belong to you, or incorrect payment history, contact the credit bureau and ask for a correction. You certainly don’t want someone else’s information to affect your own credit.

You cannot improve your credit if you have no credit. Keep your old credit accounts open – The longer your history of using credit responsibly, the better. If your credit report documents old debts that have been paid in full, it will positively affect your credit score.

It may seem strange if you have low credit, but you have to use credit to improve your credit score. Continue to use your credit card and pay it on time. You can also buy a car from Birchwood Credit and rebuild your credit by making regular car payments. Credit utilization depends on your ability to use credit and pay it back responsibly as it shows lenders that you are a reliable borrower. The more you use credit and repay it on time, the better your credit score will improve.

If your credit card provider offers you a credit limit increase, take it. The main thing is not to spend more than you can. If you are offered an extension, it means the lender thinks you have more credit at your disposal. If you continue to pay your bills on time and keep your credit card balances below 50% of your limit, your credit score will continue to rise.

How To Increase Your Credit Limit: Everything You Need To Know

This is a common tip that comes up often but may be the most important. Paying your bills on time is one of the easiest things you can do to improve your credit score. Your payment history accounts for approximately 35% of your credit score, so if you consistently make late or missed payments, your score will be affected.

One way to make step 8 easier is to automate your payments. For any debt with fixed payments, automatic payments will ensure that no payment is ever missed. If you bank online, you can also set up alerts to let you know when your credit card bill is due. You can automate payments and set reminders so you don’t have to worry about those payments.

When a potential lender reviews your credit history to make a final decision on a loan application, it’s called a “hard inquiry.” These credit checks will lower your score and typically stay on your report for two years. If you can, avoid hard checks or at least keep them to a minimum. It’s a good idea to educate yourself about how credit checks affect your credit score.

Stay up to date with your credit history. Look at your credit card bills and make sure there are no errors. Make sure you make all payments on time. Last, but certainly not least, get your free credit report every year and make sure there are no discrepancies. Even if your credit isn’t where you want it to be, if you know where you stand, you’re in a better position to make changes.

Knowing Your Credit Score And How To Improve It

At Birchwood Credit, we don’t look at your credit score in isolation. We look at your entire financial situation and approve all types of credit. Since we lend our own money through our in-house financing, we are able to offer better rates, repayment terms and loan options to our customers.

The first step to financial freedom is knowing where you stand. You can get your free credit report with our Secure Credit Check and start rebuilding your credit with the support of our team. All you have to do is fill out the form on our website and one of our financial managers will book an appointment to review your score and help you plan your financial goals.

Our offices have reopened, if you prefer to shop from the comfort of your home, you can do so through our Buy From Home program. Your entire buying experience will be 100% contactless, from loan approval and vehicle purchase to test drive and delivery. You will also get $1000 off and other additional benefits. visit us

Shout out to our team for their amazing work! Whether you have questions about budgets, inventory, or credit repair—our team is ready to help: https://bit.ly/3RfZxrH.

How To Improve Your Credit Score: 10 Step Guide

You need an extra safe car when it’s the rainy season. We guarantee that all our models are zombie-proof ?

Applying for a car loan doesn’t have to be stressful. We only ask for the information we need and it takes less than three minutes to complete your application. Get started now!Your credit score can affect every financial decision you make in the future. If you plan to apply for a new mortgage, buy a new car, or qualify for a loan or credit card, a bad or poor credit score will affect your ability to secure these items.

However, there are simple things you can do to start today that will help boost your credit score. In this blog, we’ll go over some proactive steps you can take to get better credit.

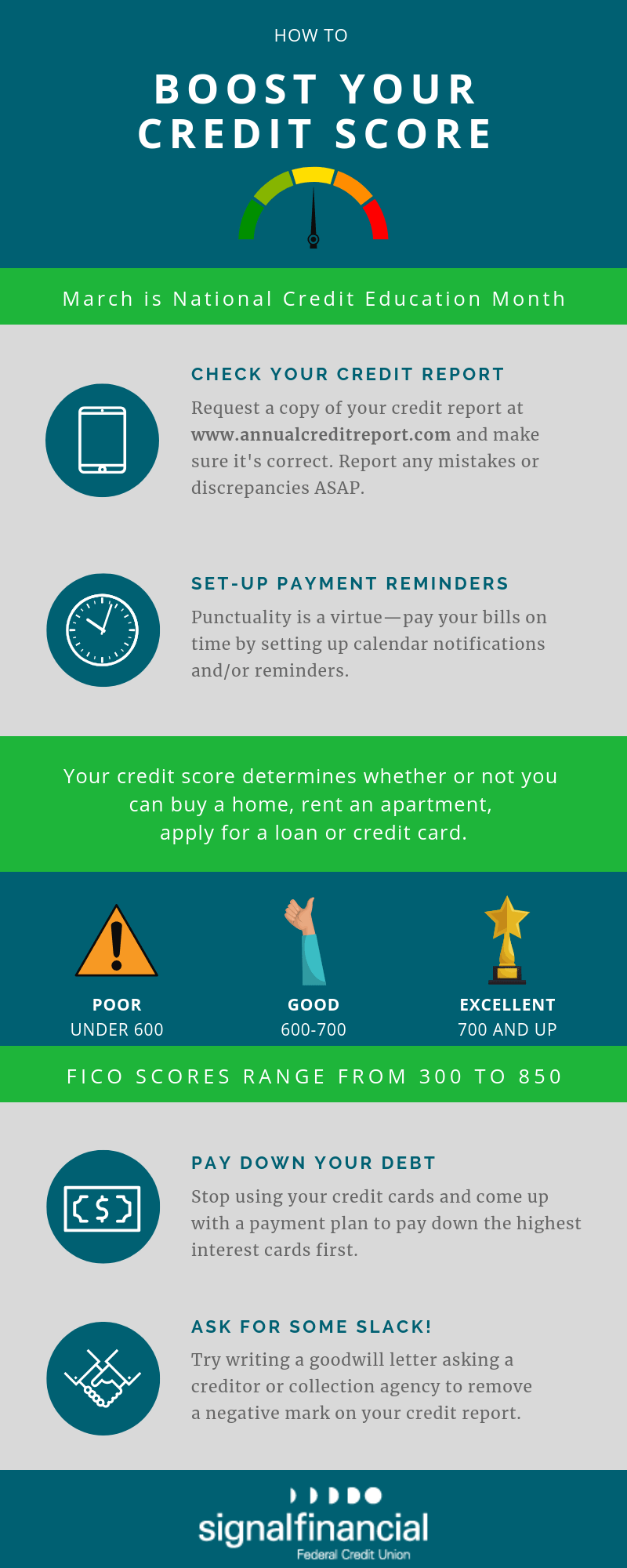

Before we explore tips to increase your credit rating, we must first establish what a credit score is and what a good credit score is. Your credit score is a number that lets a lender know how risky it is to lend you money. A common credit score used by lenders is the FICO score, a score created by Fair Isaac Corporation that combines various factors from your credit report into a score.

How To Improve Your Cibil Score Immediately (10 Smart Steps)

Raising your credit score isn’t an overnight process, but there are simple things you can do that will help bump up your FICO cr

edit score.

This may seem like an obvious step to take, but paying your bills on time will have the biggest impact on your FICO score. After all, a credit score is a rating used to notify lenders of how reliable you are in repaying borrowed money. So, it’s no surprise that 35% of the FICO score calculation comes from making on-time payments.

Check with your credit card company to see when your balance is pulled for a credit check (usually at the end of the month), and set reminders for yourself to make your payments. Your creditor may also offer auto-payments, which can be set up to ensure you make the minimum payment each month. Making that payment every month will ensure that you have no delinquent payments in your history.

The second biggest contributing factor to your credit score is your credit utilization, also known as your credit limit. This makes up 30% of your FICO score.

How To Boost Your Credit Score

It’s always best to pay off your credit card bill in full, but if you can’t, aim to use less than 30% of your credit by the time the payment is due. This will show lenders that you are not overextended.

You can keep your monthly payments low by making micropayments, which are multiples of small payments that are easy to manage. You can even go as far as making a payment immediately after the transaction is completed. This way, you will always be sure that you are able to pay your credit bills in full.

It may seem counter-intuitive, but in some situations, extending your credit or applying for another credit card can help improve your credit.

How to boost your credit score quick, ways to boost your credit, how to boost up your credit, how to boost your credit score, how to boost your credit score quickly, how to boost up your credit score, how to boost your credit score instantly, how to boost your credit score fast, how to boost your credit fast, how to boost your, how to boost credit, how to boost your credit rating